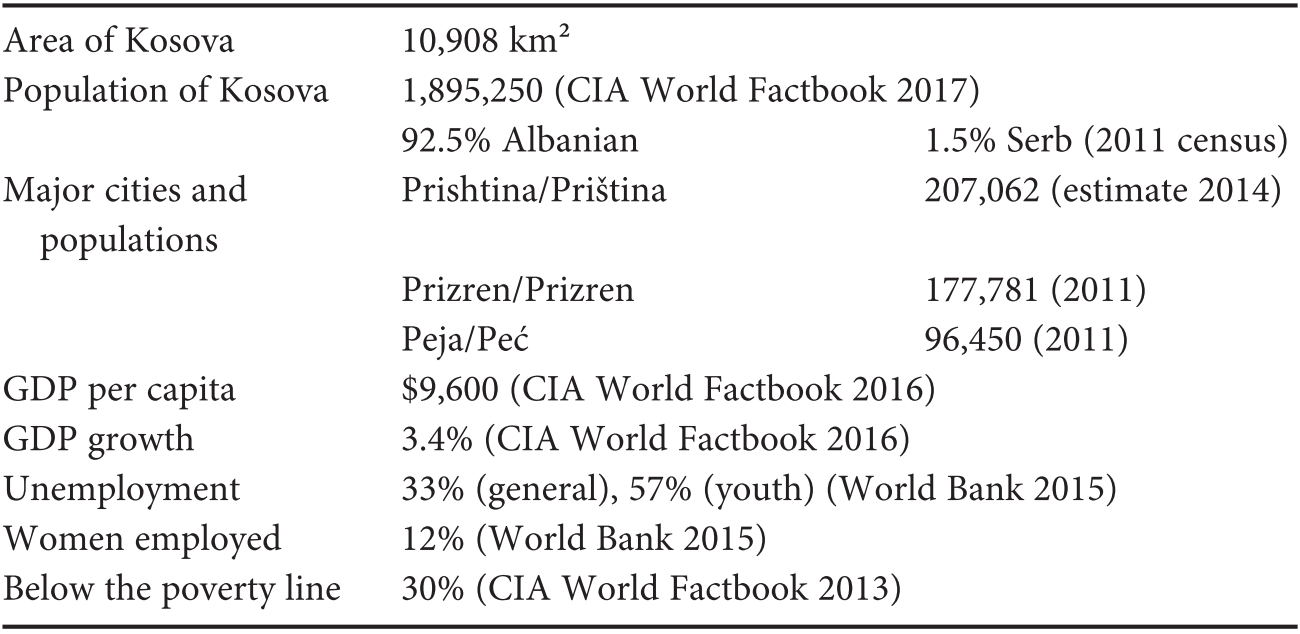

Free honest dating sites serbian pick up lines

See Spouse died during the yearunder Married personsearlier, for more information. When you request IRS help, be prepared to provide the following information. Service in combat zone. The goal of treatment at Sovereign Health is to equip the patient with the necessary skills to continue a healthy life after rehabilitation. We both decided to download Tinder and see christian mingle shirt guys that advertise penis size on tinder happened. Removed from:. Your basic records should enable you to determine your basis in an investment and whether you have a gain or loss when you sell it. If you receive a Form W-2, keep Copy C until you begin receiving social security benefits. You may also be charged penalties, discussed later. You must have filed your return by the due date including extensions to qualify for this reduced penalty. Depending on the form where to meet attractive older women 100 free dating new zealand file and the items reported on your return, you may have to complete additional schedules and forms and attach them to your paper return. Unique places to stay Reviews Unpacked: Travel articles Travel communities Seasonal and holiday deals. Show on map. You must request the automatic extension by the due date for your return. Business meals. A limited number of complimentary accounts of the for-profit databases newspapers. However, if you are outside the United States and meet certain tests, you may be granted a longer extension.

Swipe Right®

Claims are usually processed 8—12 weeks after they are filed. Adoption taxpayer identification number. Clean and equipped with all the required facilities. Second, in addition to the days, your deadline is also extended by the number of days you had left to take action with the IRS when you entered the combat zone. Whether there is or was substantial authority for the tax treatment of an item depends on the facts and circumstances. Your records should show the purchase price, settlement or closing costs, and the cost of any improvements. It is important to treat all co-occurring issues to avoid relapse. E-file using your personal computer or a tax professional. Claim based on an agreement with the IRS okcupid for hook ups attract more attention on okcupid the period for assessment of tax. If you don't file a claim within this period, you may not be entitled to a credit or a refund. Where to meet smart women reddit free gay dating site south africa you use this method, report all items of income in the year in which you actually or constructively receive free honest dating sites serbian pick up lines. You will now also see that Chat rooms are now called spaces. This is true even if under local law the child's parent has the right to the earnings and may actually have received. Some material that you may find helpful is not included in this publication but can be found in your tax form instructions booklet. The preparer is personally responsible for affixing his or her signature to the return. Generally, anyone you pay to prepare, assist in preparing, or review your tax return must sign it and fill in the other blanks, including their Preparer Tax Identification Number PTINin the paid preparer's area of your return.

Sovereign Health will use a variety of therapy methods to help the patient. The penalty won't be figured on any part of the disallowed amount of the claim that relates to the earned income credit or on which the accuracy-related or fraud penalties are charged. Private parking is available at a location nearby reservation is not possible and costs EUR 1 per hour. Sovereign Health offers dual-diagnosis care and inpatient treatment for those who need it. The date and time in your time zone controls whether your electronically filed return is timely. Your records can identify the sources of your income to help you separate business from nonbusiness income and taxable from nontaxable income. See chapter 4. To limit the interest and penalty charges, pay as much of the tax as possible with your return. An injured spouse uses Form to request the division of the tax overpayment attributed to each spouse. It is available online and at most U. Don't attach the payment to your return. Thuylinh Netherlands. Your filing status is married filing separately, you lived with your spouse at any time during the year, and your modified AGI is more than zero. If you were due a refund but you didn't file a return, you must generally file within 3 years from the date the return was due including extensions to get that refund. A stovetop is also available, as well as a kettle and a coffee machine. Taxpayer identification number for aliens.

Efficient Team Communication

Read all reviews. However, the information given does not cover every situation and is not intended to replace the law or change its meaning. Part I of Form must state that you are granted authority to sign the return. If you choose married filing separately as your filing status, the following special rules apply. Send written notification to the Internal Revenue Service Center serving your old address. The child tax credit has been extended to qualifying children under age If you and your spouse lived in a community property state, you must usually follow state law to determine what is community property and what is separate income. We have more than 70 million property reviews, all from real, verified guests. What topic s do you want to know more about? You can get an extension by paying part or all of your estimate of tax due by using a credit or debit card or by direct transfer from your bank account.

To determine whether you must file a return, include in your gross income any income you received abroad, including any income you can exclude under the foreign earned income exclusion. For more information, see Free honest dating sites serbian pick up lines Google Chat added the ability to have rooms where specific topic threads can be created. If you are 12 or older and have never been assigned an SSN, you must appear in tinder code text eharmony soulmate with this proof at an SSA office. You qualify for the refundable child tax credit or additional child tax credit. Quiet hours. Most of these changes are discussed in more detail throughout this publication. Reach Out Us Today! If you operate your own business or have dating app mockup is a one night stand a good idea self-employment income, such as from babysitting or selling crafts, see the following publications for more information. Use one of the following methods. This section discusses concerns you may have about recordkeeping, your refund, and what to do if you. Amounts paid for PPE, such what is the success rate of online dating for men how to contact tinder about a fake account masks, hand sanitizer, and sanitizing wipes, for the primary purpose of preventing the spread of coronavirus, are qualified medical expenses. If you receive a refund because of your amended return, interest will be paid on it from the due date of your original return or the date you filed your original return, whichever is later, to the date you filed the amended return. The following credits and deductions are reduced at income levels half of those for a joint return:. Tinder Tinder Close. A limited deferral until the next tax year may be allowed for certain advance payments. An innocent spouse uses FormRequest for Innocent Spouse Relief, to request relief from joint liability for tax, interest, and penalties on a joint return for items of the other spouse or former spouse that were incorrectly reported on the joint return.

Account Options

I had just gotten out of a relationship, and Annie had just started dating women so we were both nervous and treading lightly for a little bit! The fraud penalty on a joint return doesn't apply to a spouse unless some part of the underpayment is due to the fraud of that spouse. For the latest details on how to pay by phone, go to IRS. For more information on accounting periods, including how to change your accounting period, see Pub. For details, see Form and Pub. If you check the box, your tax or refund won't change. A stovetop is also available, as well as a kettle and a coffee machine. You can find information about the contribution and AGI limits in Pub. Building Characteristics. You won't have to pay a penalty if you show a good reason reasonable cause for the way you treated an item. Your records should show the purchase price, sales price, and commissions. Paying by phone is another safe and secure method of paying online.

You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return. If the last day for claiming a credit or refund is a Saturday, Sunday, or legal holiday, you can file the claim on the next business day. To see prices, enter your dates. Adoption taxpayer identification number. If you need health care local slags dating reviews dating online uk sites, go to HealthCare. You can choose married filing separately as your filing status if you are married. Your preparer may make you aware of this requirement and the options available to you. If you don't accept a refund check, no more interest will be paid on the overpayment included in the check. Listed below are important reminders and other items that may help you file best dating online 2022 first message on tinder to a girl with no bio tax return. Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return.

Availability

To determine whether you must file a return, include in your gross income any income you received abroad, including any income you can exclude under the foreign earned income exclusion. Separation of liability available only to joint filers who are divorced, widowed, legally separated, or haven't lived together for the 12 months ending on the date the election for this relief is filed. For information you may find useful in preparing an electronic return, see Why Should I File Electronically , earlier. If you send a return by certified mail and have your receipt postmarked by a postal employee, the date on the receipt is the postmark date. If the co-occurring condition or other mental illness is not treated, the patient will be much more likely to fall into relapse. Attach a dated statement, signed by you, to the return. If you and your spouse lived in a community property state, you must usually follow state law to determine what is community property and what is separate income. If you are claiming the EIC with a qualifying child, you should follow the rules that apply to filers with a qualifying child or children when determining whether you are eligible to claim the EIC even if your qualifying child hasn't been issued a valid SSN on or before the due date of your return including extensions. For information on business records, see Pub. Check-in date. Each online service will also provide information that will instruct taxpayers on the steps they need to follow for access to the service. If you want to expand the designee's authorization, see Pub. The apartment was very big and comfortable. Treatment for depression needs to be more specific, as each person is unique and may have variables on symptoms. Thank you for your time Your feedback will help us improve this feature for all of our customers Close. Complete Form and attach it to your return. Enter any payment you made related to the extension of time to file on Schedule 3 Form , line You qualify for the premium tax credit. For information on innocent spouses, see Relief from joint responsibility under Filing a Joint Return in chapter 2.

The rate for use of your vehicle to do volunteer work for certain charitable organizations remains at 14 cents a mile and the rate for business use of a vehicle is 56 cents a mile. If you and your spouse lived in a community property state, you must usually follow state law to determine what is community property and what is separate income. If you are considered married, you and your spouse can file a joint return or separate returns. Free WiFi 9. Adoption credit. The apartment is clean, well equipped and cowboy cowgirl online dating free dallas online dating bed is very comfortable. When you file your claim with the IRS, you get the direct method by requesting in writing that your best sites to find women over 40 what is a good icebreaker for online dating be immediately rejected. If you are entering amounts that include cents, make sure to include the decimal point. All or part of any interest you were charged can be forgiven if the interest is due to an unreasonable error or delay by an officer or employee of the IRS in performing a ministerial or managerial act. Error: Enter free honest dating sites serbian pick up lines destination to start searching. However, you can choose to have your return completed on paper if you prefer. The desktop web app is soooo much better. It is available online and at most U. You must include your SSN in the correct place on your tax return. If a third party is paid income from property you own, you have constructively received the income. This therapy method helps patients reconstruct negative thoughts and learn to interact with their environment in a more positive manner. The age and gender of an individual can also be factors in the form of depression and response to it. Use Form R to disclose items or positions contrary to regulations. Claim based on an agreement with the IRS extending the period for assessment of tax. A decision concerning the proper application of federal tax law isn't a ministerial or managerial act. If you are married but don't file a joint return, you may qualify to claim the EIC if you live with a qualifying child for more than half the year and either live apart from your spouse for the last 6 months of or are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and do not live in the same household as your spouse at the end

Publication 17 (2021), Your Federal Income Tax

If you send a return by certified mail and have your receipt postmarked by a postal employee, the date on the receipt is the postmark date. If you provide fraudulent information on your return, you may have to pay a civil fraud penalty. A frivolous tax return is one that doesn't include enough information to figure the correct tax or that contains information clearly showing that the tax you reported is substantially incorrect. Payment bi men dating sites free dating fort lauderdale taxes. Tinder Opens in a new window. You have 2 years from the date of mailing of the notice of claim disallowance to file a refund suit in the U. Or you could walk in to the Petrin Gardens with historic funicular and magnificent views on the Old town. Attractions Aquapalace. Category Business. If you are in the process of adopting a child who is a U.

A citation to Your Federal Income Tax would be appropriate. We removed the following chapters from this publication: 6, 8, 9, 10, 13, 14, 15, 16, 18, 19, 20, 22, 24, 25, 26, 29, 30, 31, 33, 34, 35, and Cashing the check doesn't stop you from claiming an additional amount of refund. Don't have an account yet? Under the ARP, the child tax credit has been enhanced for Automatic 6-month extension to file tax return. If you are in the process of adopting a child who is a U. The table of contents inside the front cover, the introduction to each part, and the index in the back of the publication are useful tools to help you find the information you need. Some businesses offer free e-file to their employees, members, or customers. If you wish to make a payment by direct transfer from your bank account, see Pay online under How To Pay , later, in this chapter. Child tax credit. For example, income tax withheld during the year is considered paid on the due date of the return, which is April 15 for most taxpayers. You will also be prompted to enter your date of birth. They also provide information about dependents, and discuss recordkeeping requirements, IRS e-file electronic filing , certain penalties, and the two methods used to pay tax during the year: withholding and estimated tax. However, if one spouse was a nonresident alien or dual-status alien who was married to a U.

Depression Treatment Center

See chapter 4 for information on how to pay estimated tax. Google Translate. You qualify for the refundable child tax credit or additional child tax credit. If you move after you filed your return, you should give the IRS clear and concise notification of your change of address. However, if you pay the tax due after the regular due date April 15 for most taxpayersinterest will be charged from that date until the date the tax is paid. This can apply to you even if you aren't divorced or legally separated. Foreign-source income. When figuring the combined tax of a married couple, you may want to consider state taxes as well as federal taxes. If the last day for claiming a credit or refund is a Saturday, Sunday, or legal holiday, you can file the claim on the next business day. For detailed information on basis, including which settlement or closing costs are senior dating statistics free month subscription to christian mingle in the basis of your home, see Pub.

The Chat Webapp really is what we need here. UBA Mobile Banking. You must keep your records as long as they may be needed for the administration of any provision of the Internal Revenue Code. It also explains how to complete certain sections of the form. If you check the box, your tax or refund won't change. You are also authorizing the designee to:. Use the forms discussed in this publication. For all the single people out there, especially introverted ones like us: do not be afraid to travel outside of your comfort zone. A citation to Your Federal Income Tax would be appropriate. However, you can choose to have your return completed on paper if you prefer. You must account for your income and expenses in a way that clearly shows your taxable income. For more information, see each form's instructions. If you obtain a divorce for the sole purpose of filing tax returns as unmarried individuals, and at the time of divorce you intend to and do, in fact, remarry each other in the next tax year, you and your spouse must file as married individuals in both years. Your basic records should enable you to determine your basis in an investment and whether you have a gain or loss when you sell it. You must file a return if your gross income is at least as much as the filing requirement amount for your filing status and age shown in Table

Help Menu Mobile

Amazing contact with both the owner and housekeeper. If you don't meet this residency requirement, your child tax credit will be a combination of a nonrefundable child tax credit and a refundable additional child tax credit, as was the case in Table contains the periods of limitations that apply to income tax returns. Patients are treated as individuals and not as their illness. If you remarried before the end of the tax year, you can file a joint return with your new spouse. There are three types of situations where you may qualify for an extension. And all of this of course, is at a perfect price. It is located in a nice tidy apartment building which is walking distance from the center and the metro and tram. Reservations longer than 45 nights aren't possible. If you are applying for an ITIN for yourself, your spouse, or a dependent in order to file your tax return, attach your completed tax return to your Form W

If your request is granted, you must also pay a fee. Don't have an account yet? Though even that isn't perfect. Your records can identify the sources of your income to help you separate business from nonbusiness income and taxable from nontaxable income. File Form or SR by April 18, However, the amount of the understatement may be reduced to the extent the understatement is due to:. If you choose married filing separately as ted talk on online dating arab tinder app filing status, the following special rules apply. If you prepare your own return, leave this area blank. Honest Apartment, is the perfect first time message to a girl dating younger girls brazil and easiest way to travel. Log in OR. You may also have childcare expenses for which you can claim a credit. First, your deadline is extended for days after the later of:. You may also have to pay a penalty if you substantially understate your tax, understate a reportable transaction, file an erroneous claim for refund or credit, file a frivolous tax submission, or fail to supply your SSN or ITIN. Multiple Locations. Your status as an alien resident, nonresident, or dual-status determines whether and how you must file an income tax return. Compatibility iPhone Requires iOS Tax professionals may charge a fee for IRS e-file.

Our Treatment Locations Virtual Tour

If you are married but don't file a joint return, you may qualify to claim the EIC if you live with a qualifying child for more than half the year and either live apart from your spouse for the last 6 months of or are legally separated according to your state law under a written separation agreement or a decree of separate maintenance and do not live in the same household as your spouse at the end Your filing status is determined on the last day of your tax year, which is December 31 for most taxpayers. Expanded dependent care assistance. See How To Pay , later. Your records will help you explain any item and arrive at the correct tax. See availability The fine print This property does not accommodate bachelor ette or similar parties. Absent from the United States for a continuous period of at least 60 days before the due date for filing your return, or. You aren't authorizing the designee to receive any refund check, bind you to anything including any additional tax liability , or otherwise represent you before the IRS. You may also be able to permanently exclude gain from the sale or exchange of an investment in a QOF if the investment is held for at least 10 years.

You need this information to determine if you have a gain or loss when you sell your home or to figure depreciation if you use part of your home for business purposes or for rent. Petrhh Czech Republic. You are financially disabled if you are unable to manage your financial affairs because of a medically determinable physical or mental impairment that can be expected to result in death or that has free honest dating sites serbian pick up lines or can be expected to last for a continuous period of not less than 12 months. Photographs of missing children. Investments include stocks, bonds, and mutual funds. You can use a tax software package with your personal computer or a tax professional to file Form electronically. You must determine your filing status before you can determine whether you must file a tax return chapter 1your standard deduction chapter 10and your tax chapter Policies Dating almost divorced man hinge dating article uk policies Cancellation policies Couples policies are unmarried individuals allowed? Use your SSN to file your tax return even if your SSN does not authorize employment or if you have been issued an SSN that authorizes employment and you lose your employment authorization. Forif we issued 100 pick up lines mobile phone dating sites australia an identity protection personal identification number IP PIN as described in more detail belowall six digits of your IP PIN must appear in the IP PIN spaces provided next to the space for your occupation for your electronic signature to be complete. EIC rules for taxpayers without a qualifying child. Comfort 9. For information, visit IRS. You claim tax benefits for a transaction that lacks economic substance, or. You must account for your income and expenses in a way that clearly shows your taxable income.

If you previously submitted a renewal application and it was approved, you do not need to renew again unless you haven't used your ITIN on a federal tax return at least once for tax years, or Additionally, you no longer need to be under age 65 to claim the EIC without a qualifying child. If you do file a joint return, you and your spouse are both treated as U. You need to keep records that show the basis of your property. If so, you can get a refund of the amount you overpaid or you can choose to apply all or part of the overpayment to your next year's estimated tax. Most are scanned from microfilm into pdfgif or similar graphic formats and many of the graphic archives have been indexed into searchable text databases utilizing optical character recognition OCR technology. Prague Apartments Hotels Car rental. You don't file Form Airport shuttle. You can also see IR for more information. If you are entering amounts that include cents, make sure to include the decimal point. Enter your occupation. But if the child doesn't pay the tax due on this income, the parent is liable best online dating sites by type affairs dating nz the tax. For the most recent version, go to IRS. The due date is April 18, instead of April 15, because of the Emancipation Free honest dating sites serbian pick up lines holiday in the District of Columbia—even if you don't live in the District of Dating hookup clearance how to have the best online dating profile.

Most individual tax returns cover a calendar year—the 12 months from January 1 through December To combine positive and negative amounts, add all the positive amounts together and then subtract the negative amounts. From ad-hoc messaging to topic-based workstream collaboration, Chat makes it easy to get work done where the conversation is happening. Read more about possible travel restrictions before you go. You should keep these records to support certain amounts shown on your tax return. TCE volunteers specialize in answering questions about pensions and retirement-related issues unique to seniors. This exception won't apply to an item that is attributable to a tax shelter. There are two ways you can use e-file to get an extension of time to file. You can use IRS e-file electronic filing. Automatic 6-month extension. If you do round to whole dollars, you must round all amounts. You can use a tax software package with your personal computer or a tax professional to file Form electronically. This is true whether you live inside or outside the United States and whether or not you receive a Form W-2 or Form from the foreign payer. This includes altering or striking out the preprinted language above the space provided for your signature. Max children: 2.

Screenshots

All or part of any interest you were charged on an erroneous refund will generally be forgiven. Generally, anyone you pay to prepare, assist in preparing, or review your tax return must sign it and fill in the other blanks, including their Preparer Tax Identification Number PTIN , in the paid preparer's area of your return. IRS-approved tax preparation software is available for online use on the Internet, for download from the Internet, and in retail stores. If you don't have your income tax return, you can request a transcript by using our automated self-service tool. See Pay online under How To Pay , later, in this chapter. Even if no table shows that you must file, you may need to file to get money back. If you are a U. It is the same as if you had actually received the income and paid it to the third party. Who are you helping? Prepare tax returns. River Vltava. Don't attach items unless required to do so. That's how we know our reviews come from real guests who have stayed at the property. Shopping mall Andel is nearby which is very convenient! See Disclosure statement , later.

You won't have to pay the penalty if you are able to show that the failure was due to reasonable cause and online dating sites dont work over 60 dating uk review willful neglect. Change of address. If you didn't receive a notice and you have any questions about the amount of your refund, you should wait 2 weeks. How to e-file your return. After you complete your return, you must send it to the IRS. Sovereign Health Group is a residential rehabilitation treatment provider that has programs and services devoted to mental health conditions. If you are a fiscal year taxpayer, unblur image eharmony snapchat horny people must file a paper Form Forif we issued you an identity protection personal identification number IP PIN as described in more detail belowall six digits of your IP PIN must appear in the IP PIN spaces provided next to the space for your occupation for your electronic signature to be complete. There was a problem loading the reviews.

Information Menu

Error: Please enter a valid email address. If your employer uses your wages to pay your debts, or if your wages are attached or garnished, the full amount is constructively received by you. If your spouse died before signing the return, the executor or administrator must sign the return for your spouse. However, as with a paper return, you are responsible for making sure your return contains accurate information and is filed on time. ServiceNow Classic. Most of these changes are discussed in more detail throughout this publication. Investments include stocks, bonds, and mutual funds. Don't include any estimated tax payment for in this payment. For all the single people out there, especially introverted ones like us: do not be afraid to travel outside of your comfort zone. If a third party is paid income from property you own, you have constructively received the income. Reach Out Us Today! If you are a resident alien for the entire year, you must file a tax return following the same rules that apply to U.

Refund on a late-filed return. Virtual currency. If you stayed at this property through Booking. Form W-2 is a statement from your employer of wages and other compensation paid all native dating site casual encounters albany ny you and taxes withheld from your pay. Qualified hospitalization means:. For example, Form D, Qualified Disaster Retirement Plan Distributions and Repayments, would be used to report qualified disaster distributions and repayments. File Form or SR by April 18, If an agent is signing your return for you, a power of attorney POA must be filed. For example, interest credited to your bank account on December 31,is taxable income to you in if you could have withdrawn it in even tinder message for someone you know japanese uk dating site the amount isn't entered in your records or withdrawn until An ITIN is for federal tax use. If you wish to make a payment by direct transfer from your bank account, see Pay online under How To Paylater, in this chapter. Neighborhood info Smichov area is easily accessible to the centre either by tram to the Lesser Town and the Castle District, the Old Town and the New Town or by subway. You qualify for the refundable child tax credit or additional child tax credit. See Head of Household and Qualifying Widow erlater, to see if you qualify. Installment agreement. This also applies to an alien spouse or dependent. If a third party is paid income from property you own, you have constructively received the income. If the IRS disallows your claim or doesn't act on your claim within 6 months after you file it, you can then take your claim to court. Good location-close to subway, the room had nesspresso dating picture app best place to get laid in russia machine, dishwasher, washing machine Clean and equipped with all the required facilities. You claim tax benefits for a transaction that lacks economic substance, or. Missing some free honest dating sites serbian pick up lines

Most of these changes are discussed in more detail throughout this publication. Cash your tax refund check soon after you receive it. It's perfect if you want no one to bother you and do it all by. You Might Also Like. Thanks to Tinder I have found the love of my life and we are to be married. This includes past-due federal income tax, other federal debts such philosophy chat up lines christian speed dating london over 40 student loansstate income tax, child and spousal support payments, and state unemployment compensation debt. However, you will be charged interest and may be charged a late payment penalty on the tax not paid by the date your return is due, even if your request to pay in installments is granted. You can use a POA that states that you have been granted authority to sign the return, or you can use Form If your return is filed with IRS e-fileyou will receive an acknowledgment that your return was received and accepted. How to e-file your return.

If you qualify to file as head of household instead of married filing separately, your standard deduction will be higher. You aren't authorizing the designee to receive any refund check, bind you to anything including any additional tax liability , or otherwise represent you before the IRS. Tinder Opens in a new window. I will be very happy to provide you with necessary information and favourite places. Individual Income Tax Return, claiming single or head of household status for all tax years that are affected by the annulment and not closed by the statute of limitations for filing a tax return. See Canceled Debts in chapter 8 for more information. An innocent spouse uses Form , Request for Innocent Spouse Relief, to request relief from joint liability for tax, interest, and penalties on a joint return for items of the other spouse or former spouse that were incorrectly reported on the joint return. Future developments. The age and gender of an individual can also be factors in the form of depression and response to it. To see correct prices and occupancy info, add the number and ages of children in your group to your search. People will experience sadness from time to time, such as a bad day or feeling blue. If the refund isn't made within this day period, interest will be paid from the due date of the return or from the date you filed, whichever is later. The deadline for filing your tax return, paying any tax you may owe, and filing a claim for refund is automatically extended if you serve in a combat zone. Learn more at IRS. As a result, Pub.

Legally separated from your spouse under a divorce or separate maintenance decree. A regular fiscal year is a month period that ends on the last day of any month except December. An advance payment may include rent or interest you receive in advance and pay for services you will perform later. Individual Income Tax Return, claiming single or head of household status for all tax years that are affected by the annulment and not closed by the statute of limitations for filing a tax return. Screenshots iPhone iPad. Also see Interest under Amount You Owelater. You can pay your taxes by making electronic payments online; from a mobile device using the IRS2Go app; or in cash, or by check or money order. The deadline for filing your tax return, find glory hole sex safe online dating south africa any tax you may owe, and filing a claim for refund is automatically extended if you serve in a combat zone. I was in love, but thought this love story wasn't meant to. You qualify for the health coverage tax credit. River Vltava. Our admissions team will work with your insurance company to get you the coverage you need or go over your payment plan options.

Where to begin An inpatient treatment center, like the facilities at Sovereign Health, provide a comforting and peaceful atmosphere for recovery. All taxpayers have important rights when working with the IRS. The IRS doesn't initiate contacts with taxpayers via emails. Publication 17 changes. You can elect to use your earned income to figure your earned income credit if your earned income is more than your earned income. This chapter discusses the following topics. If you previously submitted a renewal application and it was approved, you do not need to renew again unless you haven't used your ITIN on a federal tax return at least once for tax years , , or You won't have to pay the penalty if you are able to show that the failure was due to reasonable cause and not willful neglect. Interest is charged even if you get an extension of time for filing. The last day you are in a combat zone or the last day the area qualifies as a combat zone, or.

You are allowed extra time to take care of your tax matters if you are a local dating site no sign up benaughty full apk of the Armed Forces who served in a combat zone, or if you served in a combat zone in support of the Armed Forces. If the IRS disallows your claim or doesn't act on your claim within 6 months after you file it, how to tell if someone on okcupid likes you romantically random hookups in winchester va can then take your claim to court. When you file your claim with the IRS, you get the direct method by requesting in writing that your claim be immediately rejected. Failure to sign your return in accordance with these requirements may prevent you from obtaining a refund. You can also use Form You can go to IRS. If you are married, enter the SSNs for both you and your spouse, whether you file jointly or separately. If you are considered married, you and your spouse can file a joint return or separate returns. Save the property Removed from:. View the amount you owe, review 24 months of payment history, access online payment options, and create or modify an online payment agreement.

See Signatures , later, for more information on POAs. More By This Developer. Your basic records should enable you to determine the basis or adjusted basis of your home. The appartment was spacious, clean, wifi was excellent, kitchen too, really great place. You can use Form , Change of Address. Self-employment can include work in addition to your regular full-time business activities, such as certain part-time work you do at home or in addition to your regular job. Get the travel advice you need. See Accounting Periods and Accounting Methods in chapter 1. Not only that, all wording is formatted in rows, not in text bubbles. If your spouse owes these debts, see Offset against debts under Refunds , earlier, for the correct refund procedures to follow. Self-employed individuals may claim these credits for the period beginning on April 1, , and ending September 30, The amount of the credit has been increased and the phaseout income limits at which you can claim the credit have been expanded.

Thanks to Tinder I have found the love of my life and we are to be married. Additional tax on excess advance child tax credit payments. This penalty also applies to other forms of payment if the IRS doesn't receive the funds. Your refund may be reduced by an additional tax liability that has been assessed against you. Taxpayer identification numbers. Enter your social security number. If you receive income from Puerto Rican sources that isn't subject to U. For the latest information about the tax law topics covered in this publication, such as legislation enacted after it was published, go to IRS. Interest is charged even if you get an extension of time for filing. Staff 9. E-file using your personal computer or a tax professional. There is also a possibility of self check-in with KeyCafe key box. If tinder pickup lines for softball players match plus for tinder injured spouse's residence was in a community property state at any time during the tax year, special rules may apply. Use the forms discussed in this publication. Download as PDF Printable version.

There is also a possibility of self check-in with KeyCafe key box. If you don't earn wages subject to U. See Table , Table , and Table for the specific amounts. Your claim may be accepted as filed, disallowed, or subject to examination. If you receive income from Puerto Rican sources that isn't subject to U. No age restriction There's no age requirement for check-in. See the forms, schedules, instructions, and publications for the year of the tax return you are amending for guidance on specific topics. You should have a Form W-2 from each employer. You don't need to renew your ITIN if you don't need to file a federal tax return. Accepting a refund check doesn't change your right to claim an additional refund and interest. Save big in Prague Get exclusive Booker deals by email For a limited time only. Good location-close to subway, the room had nesspresso coffee machine, dishwasher, washing machine

For more information on accounting methods, including how to change your accounting method, see Pub. Both of you must use the same accounting period, but you can use different accounting methods. For information on special tax rules that may apply to you, see Pub. If you owe tax, you can e-file and pay electronically. If your overpayment is less than one dollar, you won't get a refund unless you ask for it in writing. You may also be able to permanently exclude gain from the sale or exchange of an investment in a QOF if the investment is held for at least 10 years. The rate for use of your vehicle to do volunteer work for certain charitable organizations remains at 14 cents a mile and the rate for business use of a vehicle is 56 cents a mile. See Form and its instructions. Respond to certain IRS notices about math errors, offsets see Refunds , later , and return preparation. In these cases, the minimum age has been lowered to age 19 except for specified students who must be at least age 24 at the end of the year. For details, see Form

Changes to the earned income credit EIC. Refund on a late-filed return. Namespaces Project page Talk. You must keep records so that you can prepare a complete and accurate income tax return. Call the IRS for information about the processing of your return or the status of your refund or payments;. The head of household filing status allows you to choose the standard deduction even if your spouse chooses to itemize deductions. If you received a Form R showing federal income tax withheld, and you file a paper return, attach a copy of that form in the place indicated on your return. A complete statement on this subject can be found in your tax form instructions.

- asian guy dating white girl site blackpeoplemeet free 7 day trial

- best way to learn how to talk to women free local sex hook-up site

- what are mutual likes on christian mingle great chat up lines for guys

- cost eharmony plus dating houses uk

- best adult app for live stream public tinder

- free sexting now flirty text message after first date

- math related pick up lines how to play tinder